Discounts Lure High-Income Customers to Dollar Stores

Higher income consumers in the United States are crowding the aisles at dollar stores, moved to seek discounts in the paycheck-to-paycheck economy.

Highlights

PYMNTS Intelligence data indicates that high earners now account for 24% of transactions at both Dollar Tree and Dollar General, representing a significant segment of their top lines.

This shift is contributing to strong sales growth for discount retailers.

The increased appeal of discount stores to higher earners underscores a broader economic reality where approximately half of consumers earning more than $100,000 annually live paycheck to paycheck.

Higher income consumers in the United States are crowding the aisles at dollar stores, moved to seek discounts in the paycheck-to-paycheck economy.

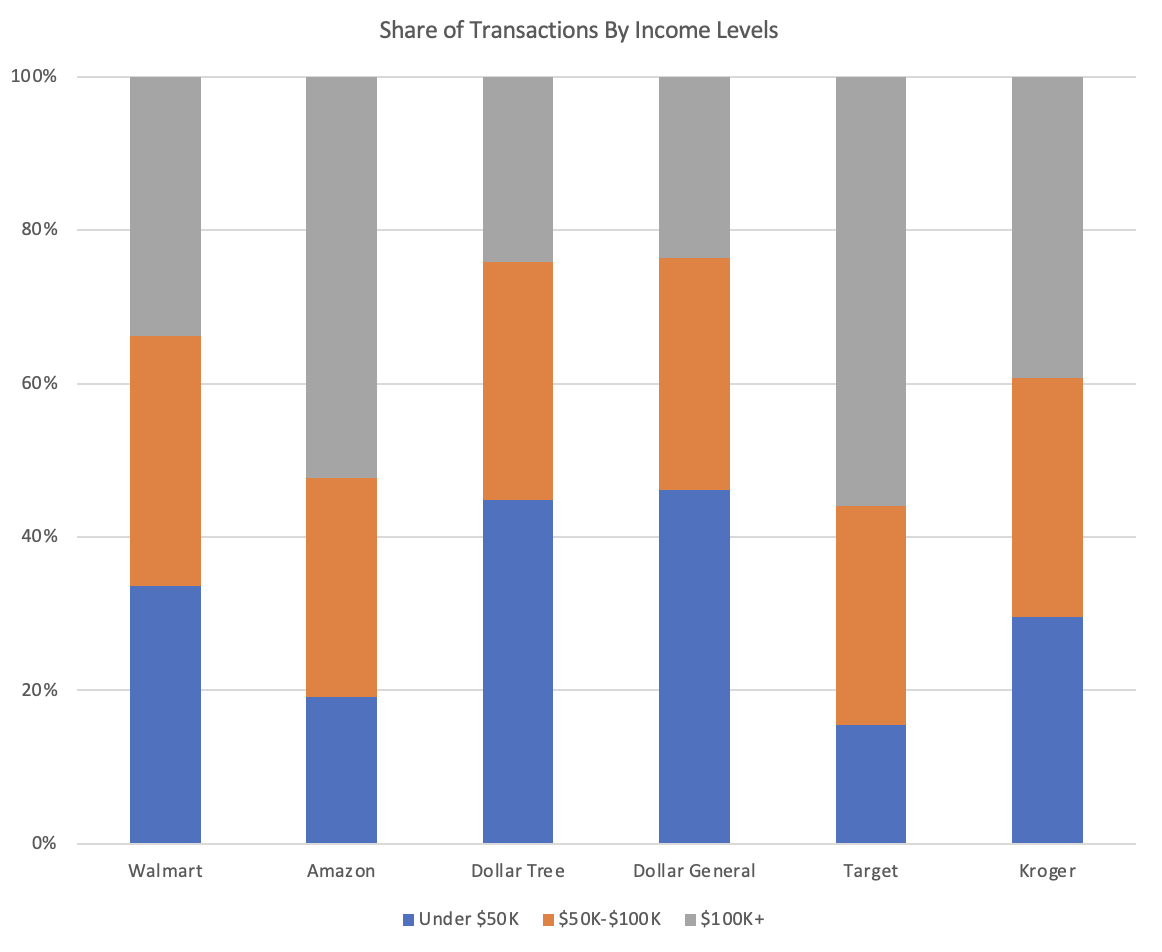

Big box retailers such as Walmart and Target have continued to be favorites among those earnings more than $100,000 each year. But PYMNTS Intelligence data shows that higher income households are also ringing up their purchases at the likes of Dollar General and Dollar Tree.

The widening appeal for higher income consumers has been spotlighted in recent earnings calls from those firms.

Early last month, during a conference call with analysts, Dollar Tree CEO Michael Creedon noted that “higher-income customers have been a meaningful growth driver for us” with what he termed a “meaningful traffic increase from customers with household incomes of more than $100,000.”

For the quarter that ended in May, the company reported that net sales increased 11.3% to $4.6 billion. Same-store net sales increased 5.4%, driven by a 2.5% increase in traffic and a 2.8% increase in average ticket. Management noted on the call that the bulk of the 2.6 million customers added in the quarter, as measured year over year, came from the cohort with incomes above the $100,000 level.

Separately, Dollar General noted in its own earnings results, also reported in early June, that same-store sales were 2.4% higher, while overall net sales were 5.3% higher to $10.4 billion. Average transaction amounts were 2.7% higher. CEO Todd Vasos said that there’s been “trade in” consumption from higher income consumers.

“In the first quarter, we saw the highest percent of trade-in customers we’ve had in the last four years,” Vasos said during the conference call. “While our core customer remains financially constrained, we have seen increased trade-in activity from both middle- and higher-income customers.”

PYMNTS reporting on the quarter indicated that the company bumped up its expectations for the current quarter for same-store sales growth of 1.5% to 2.5%, up from its previous expectation of 1.2% to 2.2%.

The growth at these discounters comes as competitors such as Target have seen declines in their top lines. Same-store sales slipped 3.8%.

“In the first quarter, our team and our business faced an exceptionally challenging environment that affected our performance with declines in both traffic and sales, most notably in our discretionary categories,” Target Chair and CEO Brian Cornell said during the retailer’s latest quarterly earnings call held in May.

As seen in the chart below, which is based on data from PYMNTS Intelligence, 24% of the transactions at Dollar Tree came from shoppers with incomes above $100,000, and a commensurate 24% at Dollar General came from high earners. That’s below the mid-40% range of the lowest income cohorts making $50,000 or less, but it is still a significant slice of the population and of the top lines of these merchants.

The shift may continue, given the fact that, as PYMNTS Intelligence has found, roughly half of consumers earning more than $100,000 annually live paycheck to paycheck, and even those making more than $200,000 each year are not immune. Our data shows that recreation, personal care and everyday transactions account for about 28% of their budget.

Source: PYMNTS Intelligence

We’re always on the lookout for opportunities to partner with innovators and disruptors.

Learn More